Investment opportunities in green energy and sustainability

Investment opportunities in green energy and sustainability are rapidly expanding, driven by increasing demand for green bonds, technological innovations, and a focus on circular economy practices that minimize waste and promote sustainable consumption.

Investment opportunities in green energy and sustainability are more than just a trend; they represent a shift in how we view our economy and environment. Have you thought about how these investments could impact your financial future?

Understanding green energy and sustainability

Understanding green energy and sustainability is crucial in today’s world. As our planet faces environmental challenges, these concepts have gained importance. They represent not just a trend, but a needed shift towards preserving our natural resources.

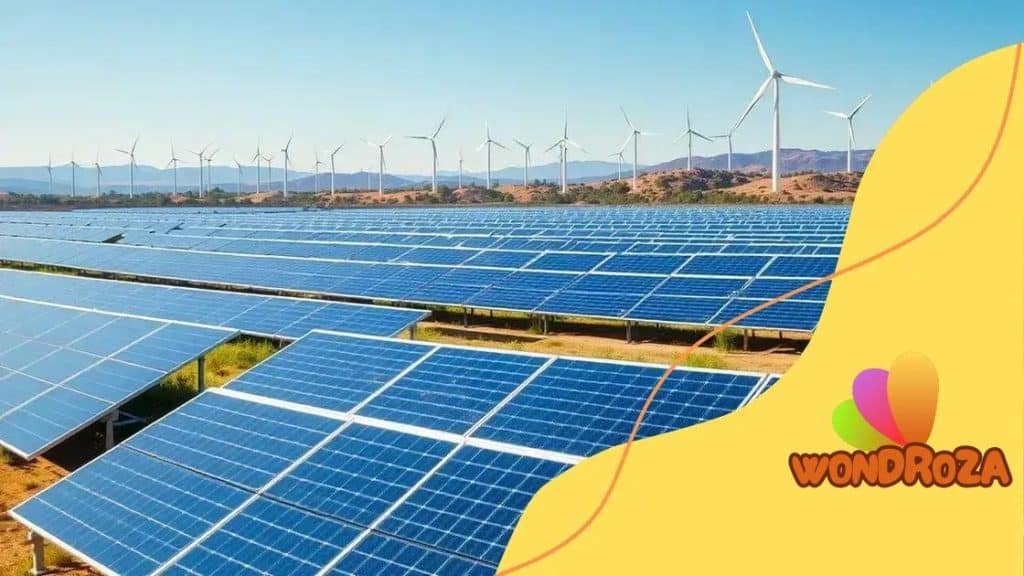

Green energy refers to energy sourced from renewable resources. This includes solar, wind, and hydroelectric power. Each type plays a role in reducing carbon emissions and fighting climate change. In contrast, sustainability is about meeting our present needs without compromising future generations. Together, they form a powerful combination for a healthier planet.

Types of Green Energy

Different renewable sources provide unique benefits. Here are some key types:

- Solar Energy: Harnesses sunlight using solar panels, providing a clean and abundant energy source.

- Wind Energy: Utilizes wind turbines to generate power, significantly lowering greenhouse gas emissions.

- Hydroelectric Energy: Generates electricity from moving water, offering a reliable energy supply.

When we discuss sustainability, it’s important to consider how these energy sources can be used wisely. For instance, transitioning to renewable energy not only helps the environment but also leads to economic benefits. It creates jobs, reduces energy costs, and fosters innovation in technology.

Moreover, engaging in sustainable practices at home can enhance your understanding of these concepts. Simple actions, like recycling or conserving energy, contribute to a larger impact. Every step counts in the journey towards a greener future.

Awareness is essential as more people recognize the importance of investing in green energy and sustainable practices. This growing interest is driving change, promoting cleaner technologies, and encouraging the development of policies that support sustainability.

By gaining a comprehensive understanding of green energy and sustainability, individuals and businesses alike can play a significant role in creating a sustainable future for everyone.

Key industries for investment

Key industries for investment in green energy and sustainability play a crucial role in shaping the future of our planet. Understanding these industries helps investors make informed decisions while contributing positively to the environment. Let’s explore some of these vital sectors.

Renewable Energy

This sector includes solar, wind, and hydro energy. Each renewable energy source offers unique advantages. For example, solar energy is rapidly growing due to decreasing costs of solar panels and technology improvements. Wind farms are becoming more efficient, harnessing the power of natural winds to generate clean electricity.

- Solar Energy: Investment in solar technology continues to rise, aiming for larger installations on homes and businesses.

- Wind Energy: Offshore and onshore wind farms are expanding, making significant contributions to electricity grids.

- Hydroelectric Power: Utilizing flowing water to generate energy is a reliable and established investment.

Electric vehicles (EVs) are another exciting area within this industry. With the push for lower emissions, investing in EV production and infrastructure presents a profitable opportunity. Companies that manufacture batteries and charging stations are also on the rise, contributing to a more sustainable transportation system.

Sustainable Agriculture

Sustainable agriculture focuses on farming methods that protect the environment. This sector encourages organic farming, which avoids harmful chemicals. Investing in companies that prioritize eco-friendly practices, water conservation, and innovative food production methods can yield great returns.

- Organic Farming: As consumer demand for organic products increases, so does the potential for profits.

- Vertical Farming: This innovative method grows food in stacked layers, utilizing less space and resources.

- Agri-tech: Technology solutions that improve farming efficiency and sustainability are gaining traction.

Investing in sustainable buildings is another promising area. Green architecture prioritizes energy efficiency, sustainable materials, and minimal environmental impact. As more businesses and homeowners seek energy-efficient solutions, this industry is rapidly growing.

As awareness grows around environmental issues, numerous industries will continue to emerge, focusing on sustainability. Understanding these key sectors aids investors in aligning their portfolios with global trends and responsible practices.

Financial benefits of sustainable investments

The financial benefits of sustainable investments are becoming increasingly apparent. As more investors seek to align their portfolios with ethical practices, they discover that sustainability can also lead to significant economic gains. This dual advantage makes sustainable investments an attractive option.

Cost Savings

One of the key benefits is cost savings. Companies that adopt sustainable practices often reduce their operational costs. For instance, using renewable energy sources can lower utility bills. Additionally, energy-efficient technologies lead to decreased maintenance and resource expenses.

- Lower Energy Costs: Utilizing solar panels or wind energy reduces reliance on traditional energy sources.

- Reduced Waste: Sustainable practices minimize waste production, leading to lower disposal fees.

- Efficient Resource Use: Companies that focus on sustainability often optimize their use of materials, driving further savings.

Investments in sustainable sectors can also generate higher returns over time. Many studies show that companies with strong sustainability credentials tend to outperform their peers. This creates a positive cycle, attracting more investments and boosting financial performance.

Market Demand

Another advantage is the growing market demand for sustainable products and services. As consumers become more environmentally conscious, they prefer brands that demonstrate social responsibility. This shift drives businesses to develop sustainable offerings, increasing their market share and profitability.

- Increased Sales: Companies that invest in sustainability often see a rise in sales from eco-conscious consumers.

- Brand Loyalty: Customers are more likely to return to brands that prioritize sustainability.

- Access to New Markets: Sustainable practices open doors to new, often underserved markets.

Moreover, sustainable investments can enhance a company’s reputation. Being recognized as an eco-friendly business builds trust with customers and investors alike. A strong reputation can lead to partnerships and collaborations that further increase profitability.

As global regulations also shift towards sustainability, investments in green initiatives align well with emerging trends. This proactive approach not only meets regulatory requirements but also positions companies for future growth.

Challenges in the green energy market

Challenges in the green energy market can hinder its growth and adoption. While the potential for renewable energy is vast, several obstacles persist. Recognizing these challenges is vital for investors and companies aiming to navigate this evolving landscape.

High Initial Costs

One significant challenge is the high initial costs of implementing green technologies. While prices for renewable energy systems like solar panels have decreased, the upfront installation expenses can still be daunting for many consumers and businesses.

- Installation Fees: Professionals are often required for installation, which adds to initial costs.

- Financing Options: Many people lack access to financing that could help cover these costs.

- Long Payback Periods: It may take several years to recoup initial investments through savings.

Despite these challenges, many are willing to invest in renewable resources for long-term savings. However, without proper support, others may hesitate.

Regulatory Hurdles

Regulatory hurdles can also impede progress in the green energy sector. Policies and regulations vary greatly between regions, creating confusion for potential investors. In some areas, outdated regulations may hinder the adoption of innovative technologies.

- Permit Delays: Securing permits for renewable energy projects can be time-consuming.

- Inconsistent Policies: Changing government policies can create uncertainty in the market.

- Grid Access: In some cases, new renewable energy projects face difficulties in connecting to existing power grids.

Efforts to overcome regulatory challenges require collaboration between stakeholders, governments, and organizations. Encouraging clear, consistent policies can aid the industry’s expansion.

Market Competition

The green energy market faces intense competition from traditional energy sources such as oil, gas, and coal. These industries often have well-established infrastructures and may receive subsidies, making it harder for renewable energy technologies to compete.

- Price Volatility: Fluctuating prices in fossil fuels can undermine the market for renewables.

- Public Perception: Some consumers still view renewable energy as less reliable than traditional sources.

- Technological Advancements: Investing in and keeping up with rapidly changing technology can be challenging.

Despite these barriers, efforts continue to shift energy consumption patterns. Consumer interest in sustainability is growing, providing opportunities for green technologies.

Future trends in sustainability investment

Future trends in sustainability investment are evolving as the world increasingly prioritizes environmental responsibility. Investors are shifting their focus toward sustainable practices that not only benefit the planet but also promise financial growth.

Increased Demand for Green Bonds

One significant trend is the rising demand for green bonds. These financial instruments are used to raise funds for projects that have positive environmental impacts. With more investors looking to support eco-friendly initiatives, green bonds are becoming more mainstream.

- Government Initiatives: Many governments are creating policies encouraging the issuance of green bonds.

- Corporate Responsibility: Companies are recognizing that green bonds can enhance their brand image and attract socially conscious investors.

- Diverse Project Financing: These bonds can fund renewable energy, clean transportation, and sustainable waste management.

The increased focus on green bonds indicates a robust future for sustainability investments.

Technological Innovations

Sustainability investments are also being driven by rapid technological innovations. Advancements in renewable technologies are opening new avenues for investment and improving efficiency in various sectors.

- Artificial Intelligence: AI is helping optimize energy consumption and improve efficiency in smart grids.

- Energy Storage Solutions: Innovations in battery technology are making renewable energy sources more reliable.

- Sustainable Agriculture Tech: New technologies are enhancing food production while minimizing environmental impact.

These innovations not only provide new investment opportunities but also enhance the effectiveness of existing sustainable practices.

Focus on Circular Economy

As sustainability grows in importance, there is a larger focus on the circular economy. This model aims to minimize waste through the continual use of resources, thus promoting sustainable consumption and production.

- Resource Recovery: Companies are investing in systems that allow for the recycling and repurposing of materials.

- Product Life Extension: Investing in technologies that extend the lifespan of products reduces the need for new materials.

- Sustainable Product Design: There is a rising trend toward designing products with end-of-life in mind.

The circular economy not only reduces waste but also provides new revenue streams and promotes resource efficiency.

Awareness among consumers regarding sustainability issues is continuously growing, influencing investment strategies. Investors are now more inclined to support options that align with their values, leading to a robust market for sustainability investment.

In conclusion, the future of sustainability investments looks bright as trends continue to evolve. With the growing demand for green bonds and technological innovations, investors have more options than ever. The focus on a circular economy will help minimize waste, create new opportunities, and enhance efficiency. As environmental awareness rises, aligning investments with sustainable practices will become increasingly crucial. Embracing these trends not only benefits investors but also promotes a healthier planet.

FAQ – Frequently Asked Questions about Sustainability Investment

What are green bonds?

Green bonds are financial instruments that raise funds for projects with positive environmental impacts, such as renewable energy and sustainable infrastructure.

Why is technology important in sustainability investment?

Technological innovations improve efficiency, reduce costs, and create new opportunities in sustainable practices, making investments more attractive.

What is a circular economy?

A circular economy aims to minimize waste by continually reusing resources, promoting sustainable production and consumption.

How does consumer awareness affect sustainability investment?

As consumers become more environmentally conscious, they prefer brands that practice sustainability, driving businesses to invest in eco-friendly solutions.